Why Cyber Security Compliance Doesn’t Belong In The IT Department’s Hands

Why Cyber Security Compliance Doesn’t Belong In The IT Department’s Hands

What if you discovered that all the hard work, investments, and time you’ve put into growing your business is at risk due to a failure of your outsourced IT company or possibly even your well-meaning (but overburdened) IT department? If you were exposed to that level of risk, wouldn’t you want someone to tell you about it?

This article is that wake-up call.

Over the last several years, the risks associated with cyber security attacks have grown in magnitude. They are no longer a low-probability hazard that will result in a minor inconvenience. Businesses of all sizes and types are getting hacked and losing hundreds of thousands of dollars, or even multiple millions, in addition to suffering significant reputational damage and loss of customer goodwill. For some, it’s a business-ending event. For nearly everyone else, it’s a substantial financial disaster that can negatively impact profits and revenue for years.

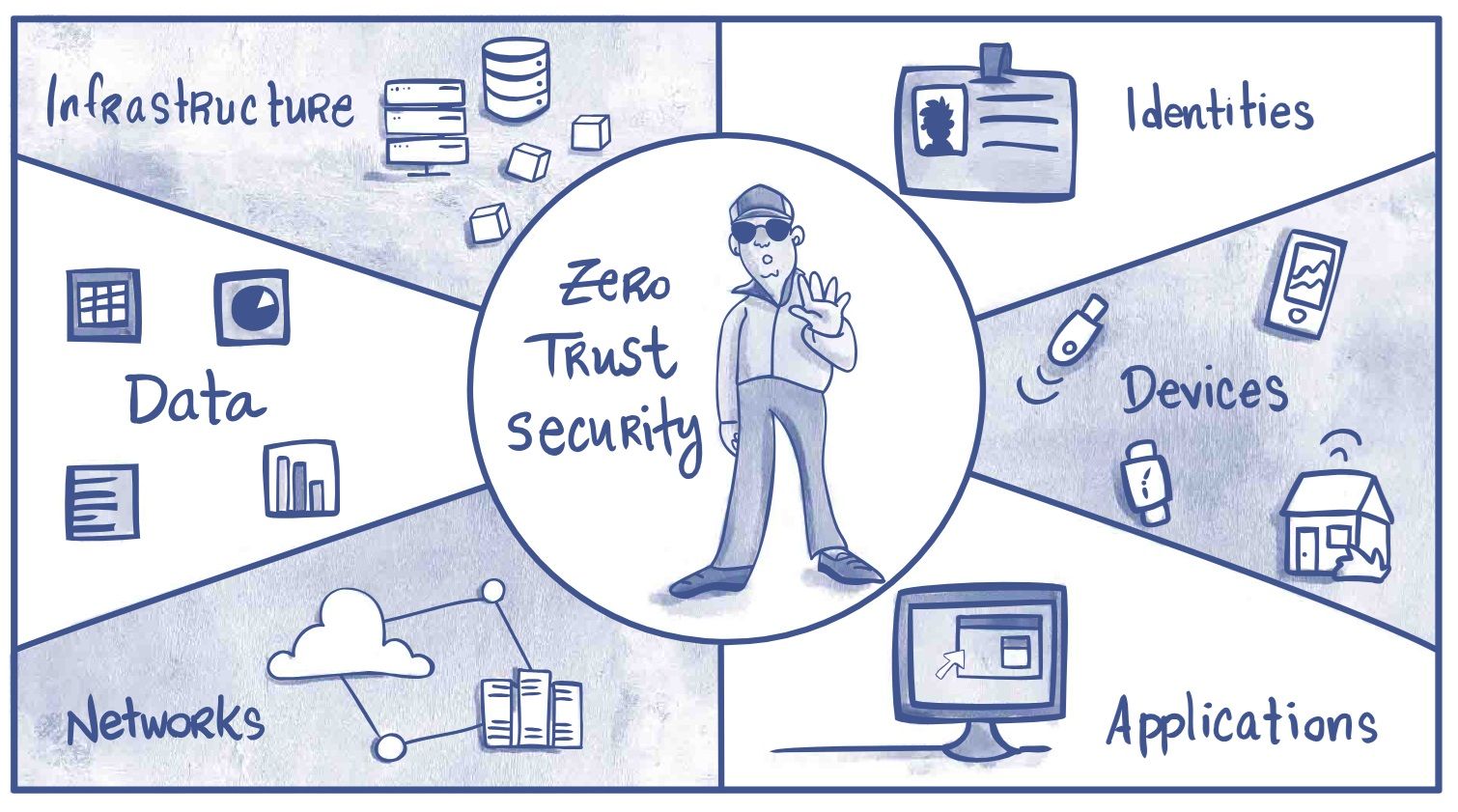

Yet too many CEOs and small business owners are still abdicating critical decisions regarding risk tolerance and compliance policies to their IT company or IT department when these decisions no longer belong there.

For example, let’s suppose you have an employee who refuses to comply with strict data security and password policies and continually fails cyber security awareness training, putting your company at risk for a cyber-attack and compliance violation. Should your IT manager or IT company fire this employee? Reprimand them? Is it the IT department’s job to manage employee behavior with company data and devices? If you say yes, the question is, when was the last time you met with them to specifically address this issue and direct them on how to monitor and manage it? Likely never – or once, a very long time ago.

Therein lies the problem. Most CEOs would agree that it’s not up to the IT department to make that call. Yet, many of these same CEOs leave it entirely up to the IT department (or outsourced IT company) to handle the situation and decide what is allowed, what isn’t, how much risk they want to take, etc.

Worse yet, many CEOs aren’t even aware that they SHOULD have such policies to ensure your company isn’t compromised or at risk – and it’s not necessarily your IT person’s job to determine what should or shouldn’t be allowed. That’s your job as the CEO.

As another example, many companies have invested in cyber liability, ransomware, or crime insurance policies to provide financial relief in a cyber-attack and cover the exorbitant legal, IT, and related costs resulting from such an event. Yet our experience shows that most insurance agents and brokers do not understand and cannot convey to the CEOs they are selling a policy to the IT requirements needed to secure a policy. Therefore, they never advise their client to make sure they get with their IT provider or internal IT to ENSURE the proper protocols are in place, or risk having coverage denied for failure to comply with the requirements in the policy they just sold them.

When a cyber event occurs, and the claim gets denied, whose fault is it? The insurance agent for not warning you? Your IT department or company for not putting in place protocols they weren’t even briefed on? Ultimately, it’s on you, which is why you, as the CEO, must ensure that decisions impacting the risk to your organization are informed, not decisions made by default.

Of course, a great IT company will bring these issues to your attention and offer guidance, but most are just keeping the “lights” on and the systems up, NOT consulting their clients on enterprise risk and legal compliance.

If you want to ensure your organization is prepared for and protected from the aftermath of a cyber-attack, click here to schedule a private consultation with one of our advisors about your concerns. It’s free of charge and may be highly eye-opening for you.